Insight into the Medical Devices Sector in 2023: Key Data and Trends

News

Overview of Certificates and Regulatory Transitions

Once again Team NB offers us a great document, with clear view of the situation for medical devices in Europe in 2023. Here is a summary.

1. Valid Certificates Overview:

- At the end of 2023, there were 19,430 valid CE certificates, indicating a steady trend over the past decade.

- The majority of these certificates are still under the Medical Device Directive (MDD) at 88%, with In Vitro Diagnostic Device (IVDD) certificates making up 10% and Active Implantable Medical Device Directive (AIMDD) certificates at 2%.

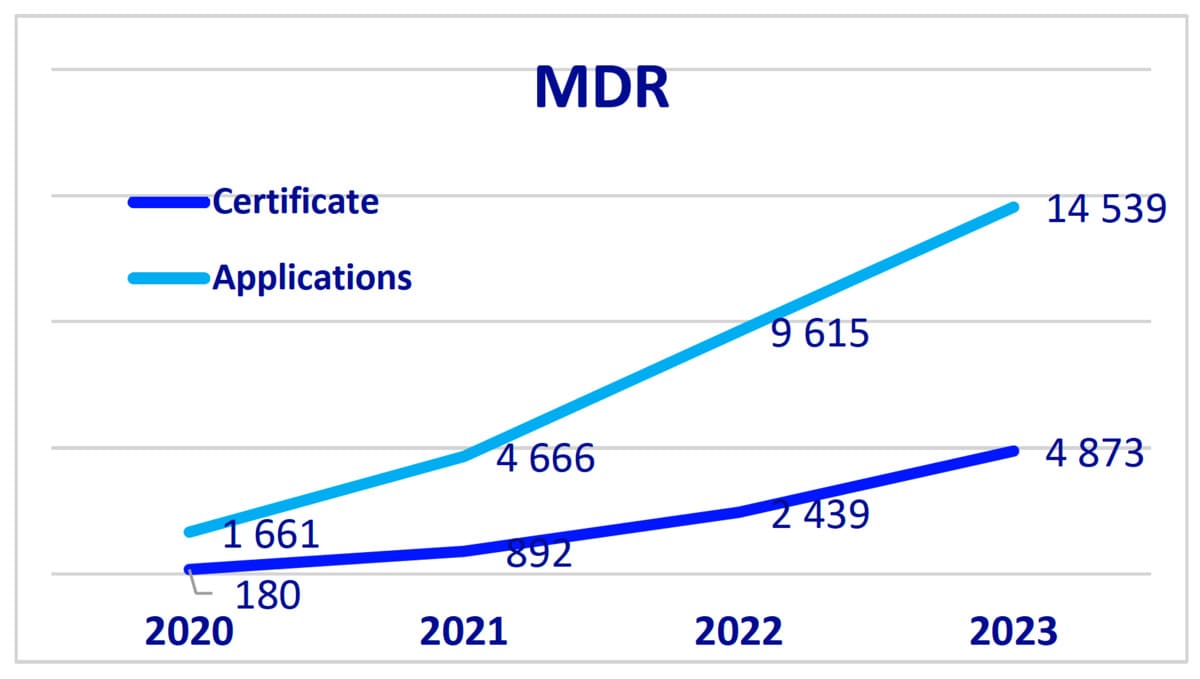

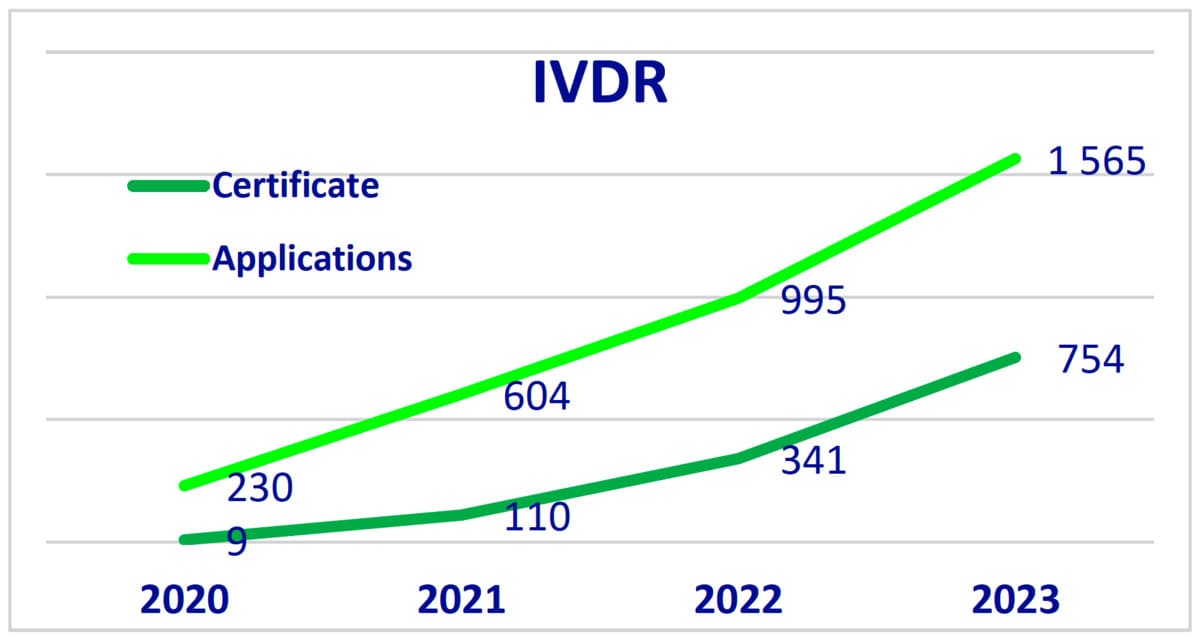

2. MDR and IVDR Applications and Certificates:

- There was significant growth in MDR (Medical Device Regulation) applications and certificates, with a total of 14,539 applications and 4,873 certificates issued in 2023.

- For IVDR (In Vitro Diagnostic Medical Device Regulation), there were 1,565 applications and 754 certificates issued.

- Team-NB members, representing the majority of designated notified bodies, accounted for 91% of MDR applications and 96% of IVDR applications.

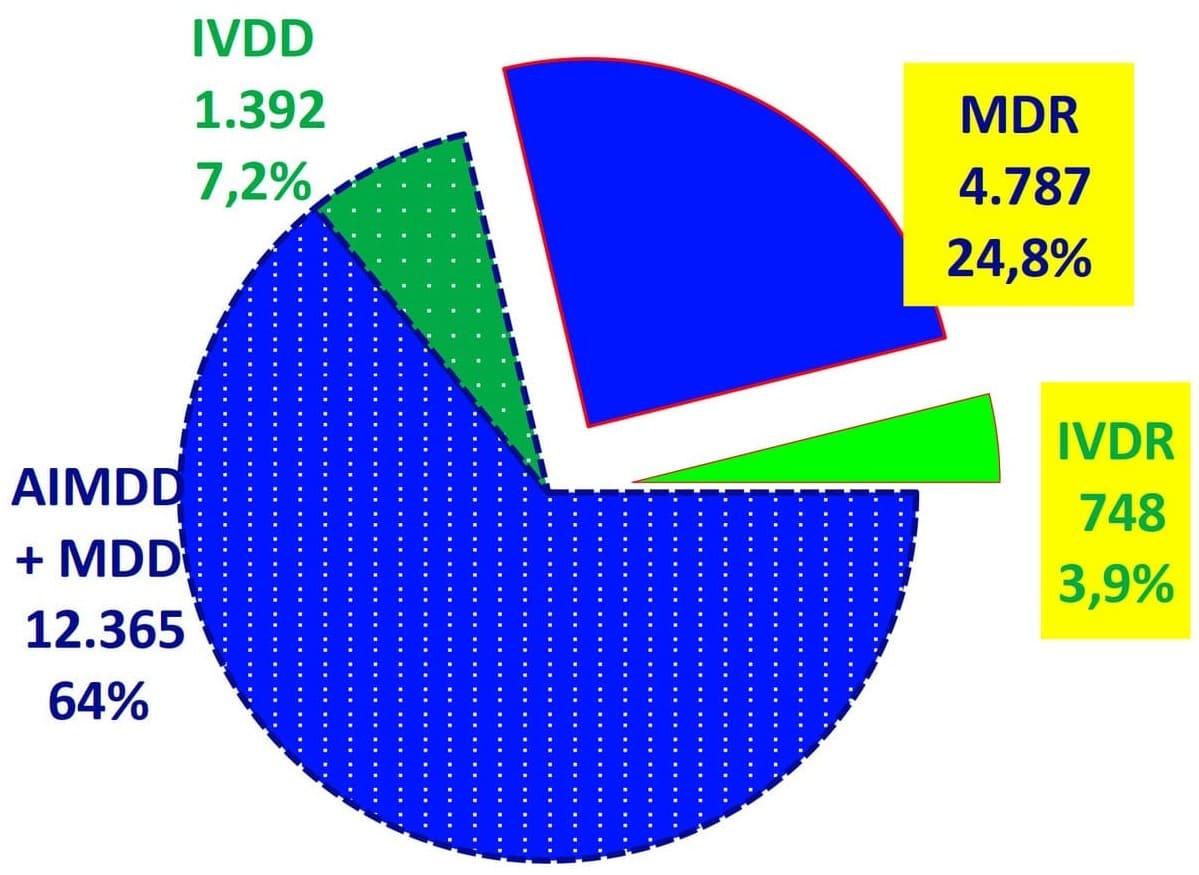

3. Distribution of Certificates:

- The breakdown of certificates shows a notable shift towards the new regulations. MDR certificates now constitute 24.8% of the total, while IVDR certificates account for 3.9%.

- This transition is critical as manufacturers move from directives to regulations, with an increased number of certificates expected under the new regulations due to more detailed requirements and classifications.

Market Dynamics and Challenges

1. Size and Distribution of Notified Bodies:

- Notified bodies are categorized based on the number of certificates issued: "big" (>1000 certificates), "medium" (350-1000 certificates), and "small" (<350 certificates). In 2023, 11% were big, 29% medium, and 60% small.

- This distribution reflects a growing number of small notified bodies, which increased by around 10% from the previous year.

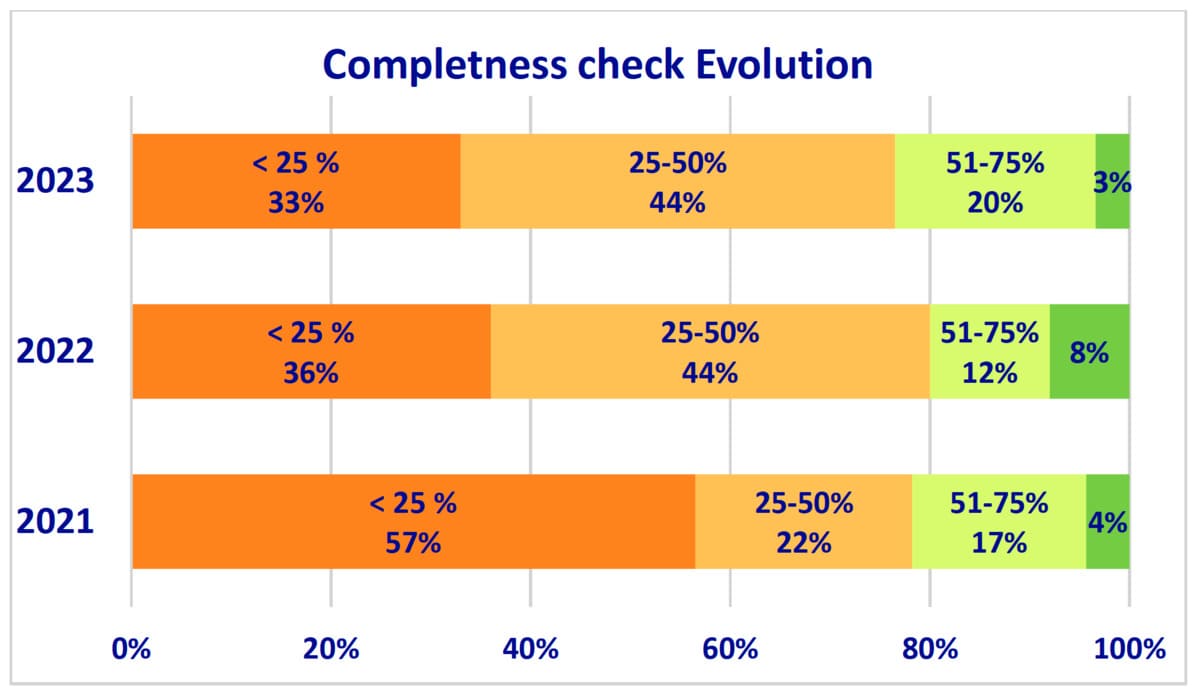

2.Completeness Checks and Technical Documentation:

- The completeness check of technical documentation, essential for regulatory compliance, saw improvements. In 2023, 87% of notified bodies performed these checks, up from 81% in 2022 and 79% in 2021.

- Despite these improvements, 75% of submissions still required additional information to start the assessment.

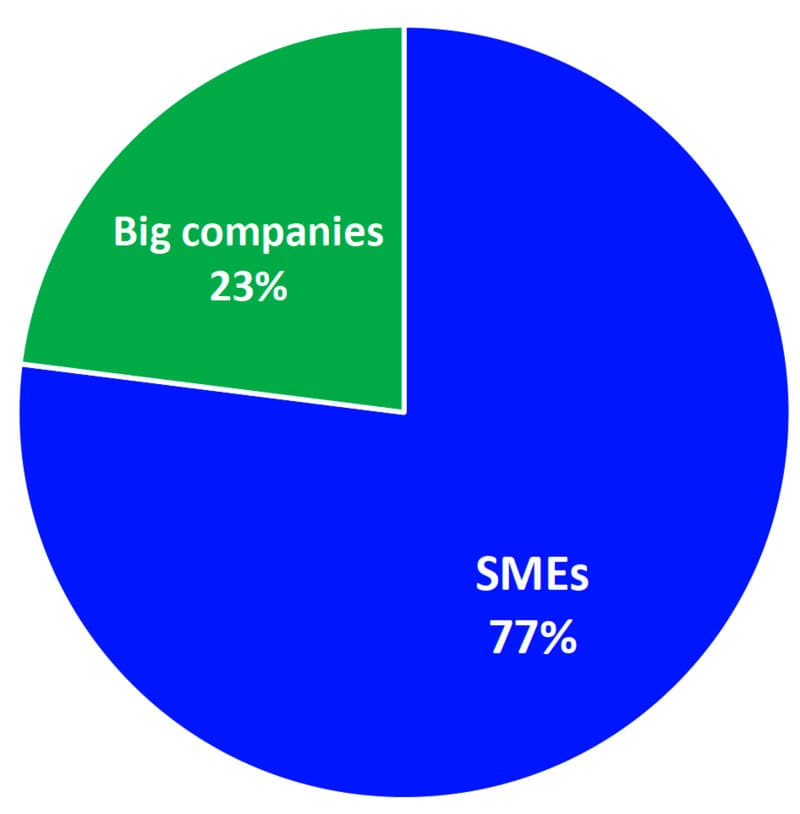

3. Access for SMEs:

- Small and Medium-sized Enterprises (SMEs) represent a significant portion of the notified bodies' activities, constituting 77% of their clientele. This highlights the crucial role SMEs play in the medical devices sector.

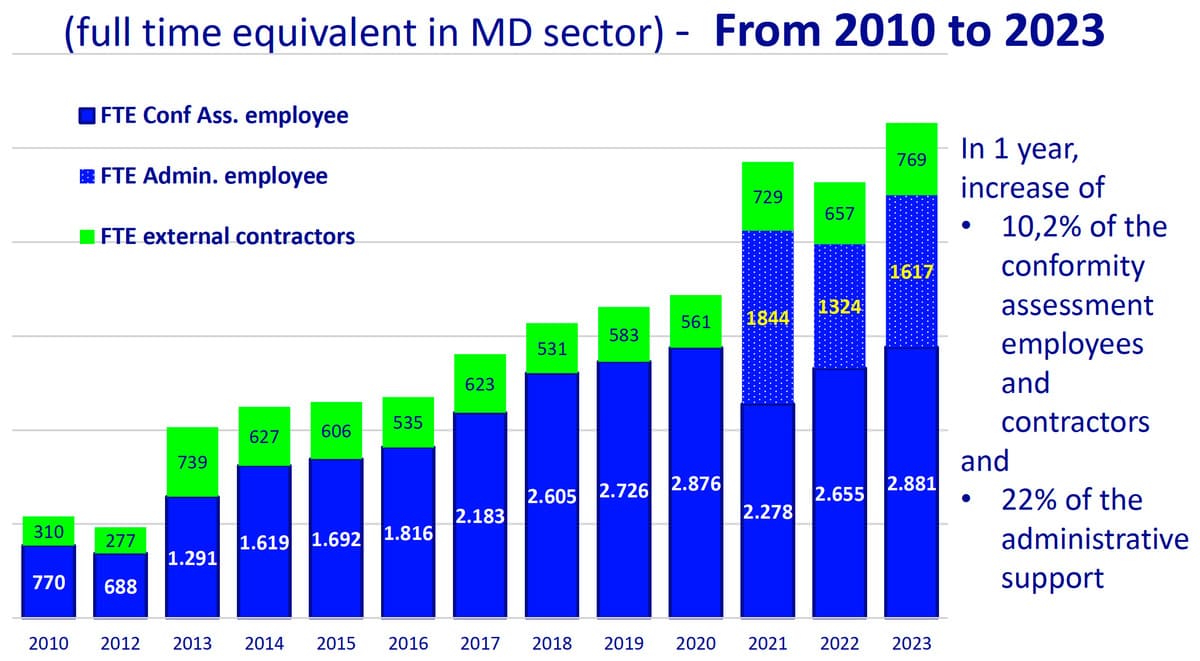

Workforce and Operational Insights

1. Staff and Resources:

- The sector saw an increase in staff dedicated to conformity assessments, with a 10.2% rise in technical employees and subcontractors in 2023. Administrative support staff also increased by 22%.

- Notified bodies are expanding their technical and administrative teams to handle the growing volume of regulatory assessments and ensure compliance with MDR and IVDR.

2. ISO 13485 and MDSAP Certifications:

- The number of ISO 13485 certificates increased for the fourth consecutive year, with 20,682 valid certificates in 2023, reflecting a 6% increase from the previous year.

- MDSAP (Medical Device Single Audit Program) certifications also saw substantial numbers, with 4,748 certificates issued.

Conclusion

The transition to MDR and IVDR is well underway, with significant increases in applications and certificates. However, manufacturers must ensure their technical documentation meets the stringent requirements to avoid delays in certification. Our consultancy firm specializes in helping medical device manufacturers navigate these regulatory landscapes, ensuring compliance and smooth transitions.

Contact us to learn how we can support your regulatory needs and streamline your submission process.